22 April, 2025

How Much Does it Cost to Start a Business in the UK (and How to Keep Those Costs to a Minimum)?

Table of Contents

If you’re looking to start a business in the UK, you know that it takes more than just a brilliant idea and some elbow grease: you need startup capital. But how much does it cost to start a business?

According to research by the Company Warehouse, the money needed to start a business in the UK is £5,000 on average, although over half of the entrepreneurs surveyed actually had less than this when starting their small business.

However, according to a Geniac study from 2016, a typical UK startup goes on to spend up to £22,756 in its first year, excluding costs related to business activities like product development, and just under 40% of startups are still around 5 years later, according to the most recent ONS (Official for National Statistics) research.

In this guide, we’ll explore how much money you need to start a business in the UK, as well as ways to minimise expenses for small business owners on a budget.

Estimated costs to start a business in the UK: Industry differences

What about typical startup expenses for small businesses? The figure of £22,756 cited above for how much money it costs to start a business in the UK is just an average, and includes the costs involved with company formation, legal, accountancy and HR, among other things. These can be easier to predict based on the company size, but startup costs will vary considerably depending on your business sector.

For instance, a freelance graphic designer creates digital products and doesn’t need to spend thousands researching and patenting a physical prototype. This is why most creative and tech founders in the UK start a business with £1,000 or less, while over two-thirds (67%) of designers and photographers had a startup budget that was less than this.

On the other end of the spectrum, consultancy, transport and event firms have higher startup costs, with the typical startup budget for these sectors sitting between £1,000 and £5,000.

Food startups have a budget of £5,000 to £10,000. This is also the case for 38% of property entrepreneurs.

The most expensive sectors include finance and recruitment, with over 75% of new companies having a budget of over £10,000 for business set-up costs. Retail, health, and leisure-focused startups have a reasonably even spread of startup budgets, investing £1,000 to over £10,000.

So make sure that you research how much investment you will need to start your business, and don’t underestimate the costs involved.

Types of startup costs

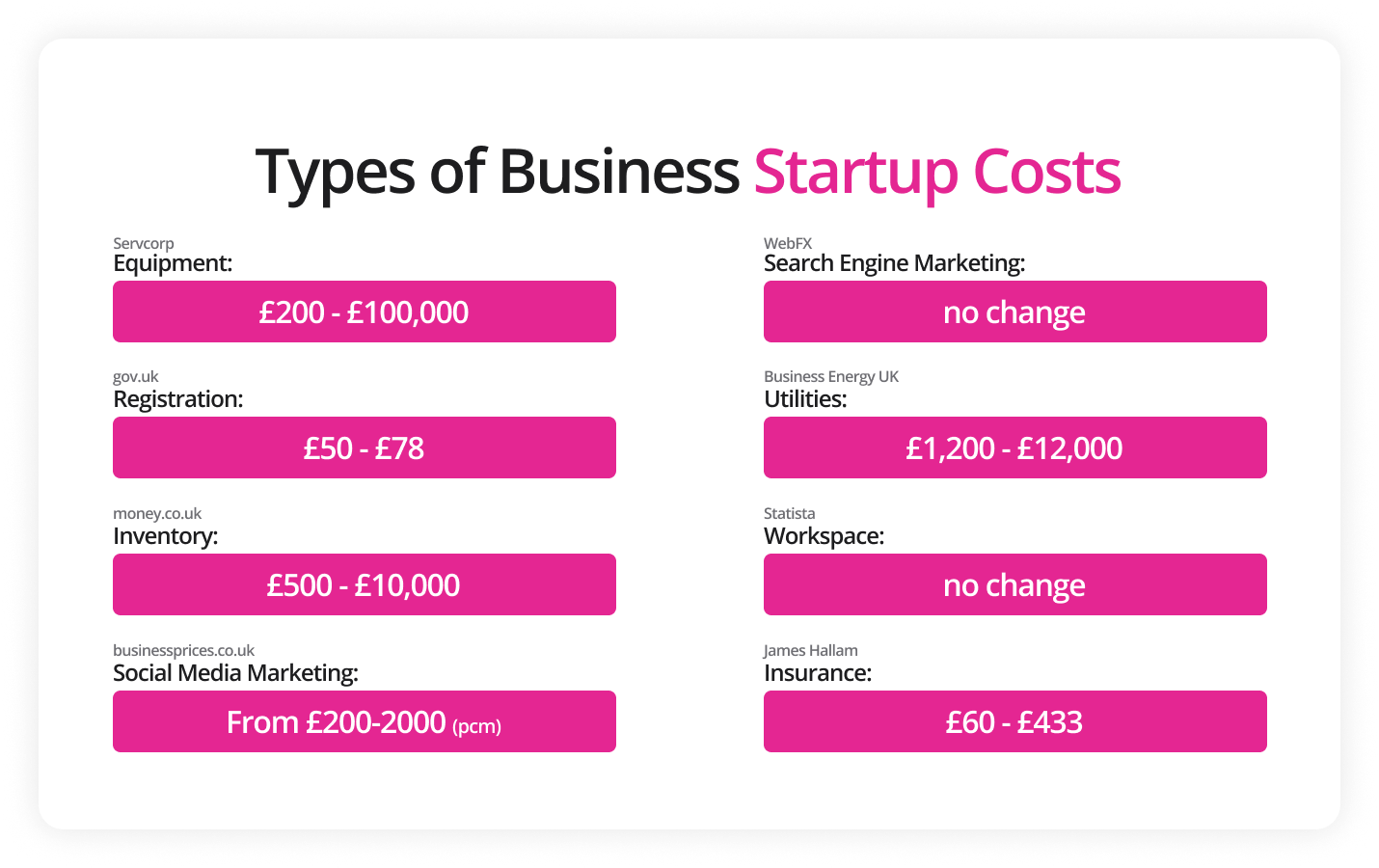

As we’ve seen, different sectors will require different startup budgets, so there’s no easy answer to figuring out how much capital you need to start a business. However, you can estimate some of the primary costs associated with starting a business in the UK. These include:

Equipment

Depending on the size and nature of your business, how much money you need to spend on equipment will vary. For example, how many computers, point-of-sale systems and credit card terminals will you need? If you require physical office space, many office rentals come unfurnished, so you’ll also need to invest in your own chairs, desks, coffee machines and so on.

Because of these various factors, estimating how much equipment will set you back is difficult, but the average spend is anywhere from £8,312 to £103,906 for a small business. However, if you’re a one-man band or operating a certain type of company with limited equipment needs, this could be as low as a few hundred pounds.

Business registration

In the UK, you can register a new business with Companies House, or via a third party, quickly and easily. Still, you’ll need to decide if you want to form a limited liability company, a partnership, or just register as a sole trader. Note that we can help you to register your new business via our company formation partner, Crunch.

Each approach for registering business entities has its pros and cons. For instance, if you register your business as a limited liability (Ltd.) company your responsibility for business debts is only up to the value of your investment. Your personal assets are therefore not at risk if the business fails. On the other hand, limited companies have a more complex business structure, and there are much stricter regulations surrounding how to file business finance reports. You’ll also need a valid UK address to use as the registered business address, unlike if you’re simply operating as a sole trader.

Technically, you can register a UK company yourself online, but using a professional accountant is a smart investment. They will help you select the right company model and prepare the paperwork for a fixed fee.

Incorporating a new limited company, or limited liability partnership (LLP) costs £50 if you do it online, via accounting software, or through a provider like Crunch—Hoxton Mix’s company formations partner. You can register your company via paper forms, but this will cost £71, while this rises to £78 for same-day registration, although this can only be done digitally.

Inventory

The scope of product inventory you need will depend on the type of business you’re setting up. If you’re starting a retail business you’ll need to invest in a sustainable level of stock, while if you plan to manufacture products you’re also going to need raw materials.

Striking a balance can be challenging when you’re first getting started. The more inventory you have in stock, the greater the potential revenue—but there’s also a higher risk. If a product proves unsuccessful, or you go out of business, your money will be tied up in stock you can’t sell.

All of the above comes at a price, which is why inventory for UK startups can cost anything from £500 – £10,000, according to Money.co.uk.

One of the reasons for the costs of starting a business in the creative or digital sector, such as graphic design, video production, or as a freelance content writer, is because you don’t require physical stock. That said, if you’re producing digital content you still need to consider how to store and back up your work, and this might require spending some money on cloud storage or hardware.

Marketing

You can have the best product or service in the world, but you won’t make any sales if no one knows about it. Costs for this can vary, and include everything from hosting events, through to branding and SEO. For the purposes of this guide we’re focusing solely on online advertising.

The average cost for initial website registration costs between £10 and £15, while ongoing site hosting fees are around £2 to £12 per month for shared hosting, while dedicated servers will cost anywhere from £60 per month up to £400 per month. If you need a specialist web designer or agency, fees will vary depending on the complexity of what’s required, so expect to pay anywhere between £500 and £15,000.

Social media platforms like Instagram and Facebook allow you to set up a business page for free, as well as run ad campaigns, and you can set a budget for this to keep costs under control. The more you pay, the greater your exposure, but you can get started boosting social posts from about £50, while the average cost for small businesses is £200 to £2,000 per month.

You can also create PPC ads for popular search engines like Google and Bing. Again, you can control the budget for this, but expect to pay £50 to £200 per month for a regular UK startup if you want to start driving traffic, although costs vary greatly depending on the competitiveness of the keywords you’re targeting, rising to as much as £10,000 per month for certain industries. However, note that in certain competitive markets you may have to budget thousands of pounds per month to generate a meaningful level of traffic.

Utilities

This expense includes heating, electricity, phone, internet, water and so on. In the UK, businesses pay separate rates for these utilities.

The average amount UK businesses spend on utilities depends on their size:

- Micro-sized £1,200 – £2,300

- Small £2,900 – £3,900

- Medium-sized £4,800 – £6,700

- Large approx £12,000

However, you should check with your chosen provider for the exact monthly prices. There may also be one-off connection fees that have to be paid upfront.

Insurance

The level of insurance coverage you should take out for your business will depend on what you do and the industry you operate in. For example, a construction company will need insurance covering potential physical harm to employees and members of the public, as well as damage to property. By contrast, a freelance bookkeeper working from their own home might only need insurance covering financial losses incurred by a client if they make a mistake.

If you’re running any kind of business that involves or comes into contact with members of the public, or is high-risk like construction, you will need public liability insurance. This protects your company in case someone claims they were injured and/or lost valuable property when on your premises.

Typically, UK startups will consider public liability insurance which is £118 per year on average for small businesses, and professional indemnity insurance at £115 per year. Employer’s liability insurance—a legal requirement if you plan on hiring anyone—is also around £60 per year for small businesses, but this can rise to around £200 for industries requiring physical labour.

Workspace

Whether you’re a one-person startup or looking to launch a multinational corporation, your chosen workspace will be one of your major expenses.

Covid accelerated the remote versus onsite work model debate, and companies are now much more willing to let employees carry out their roles either partly or fully from home. In fact, according to research, an astonishing 16% of companies worldwide are now fully remote. If this model can work for your organisation, you can essentially eliminate the workspace expense altogether.

If your business does require physical office space in the UK, the amount you have to spend will depend on where you’re based. According to research by Statista, office space varies from £40.00 per square foot per year for Leeds, up to £142.50 per square foot per year for an office in London’s West End. Statista also demonstrates that retail rents are erratic depending on where you set up shop in the UK. Currently, a shop in Bristol costs just £85 per square foot per month, but this goes up to £2,000 per square foot for a Bond Street retail location.

This means workspace costs for a UK startup can cost as much as £5,000 per month.

How to minimise costs for starting a business in the UK

Some business expenses like registering your company are unavoidable (unless you’re going to operate as a sole trader or partnership), but there are still a number of ways you can minimise your business set up costs.

Some ways to save cash include:

Build your own website

You have to pay to register a website domain name, but many of these service providers also offer free tools that allow you to build your site and set up a payment portal using popular platforms like Shopify. There are also third-party website builder tools like Wix and Squarespace which have free tiers, but realistically expect to pay approximately £500 for a website builder.

Market organically

There are a number of things you can do to market your new business and generate an engaged audience for free, including creating profiles on social media platforms like Facebook, Instagram, LinkedIn and X (formerly Twitter).

If you have the time, you can also consider creating your own video and blog content, and distribute it for free via your online channels. However, if you don’t have the skills to create high quality content yourself you should consider working with a freelancer. After all, bad marketing content can do more harm than having none at all.

Shop around

Before investing your budget in equipment and stock make sure you shop around for the best deal.

If you require certain equipment, such as computers and furniture for your office, check for second-hand or refurbished goods from auction sites and charity shops, and don’t be afraid to haggle with potential suppliers over prices and shipping costs.. You should also use price comparison websites to check you’re also getting the best deals from your utility providers. Or just wait until the sales, or buy older generation tech especially during the launch of the latest iteration.

Also, just because your business is based in the UK, it doesn’t necessarily mean that you have to purchase all inventory and equipment from British retailers. Just be aware of things like import taxes, tariffs and whether or not you want to make claimsto selling ‘British-made products’, which can be a powerful USP.

Promote remote work

As we discussed above, renting a physical office space in the UK will set you back at least £35.50 per square foot per month. You’ll also need to pay utility bills for heating, lighting and internet, as well as specific building insurance in case anyone is injured or property is damaged.

On the other hand, if you decide to join the 16% of companies worldwide that have opted only to employ remote workers, or if you don’t need to hire anyone yet, you can save on all of the above expense. According to research carried out by Jose Maria Barrero, remote teams are actually 5% more productive than onsite employees.

In short, with minimal business startup costs and better employee productivity, there’s every reason to choose a remote or hybrid operating model for your UK business startup.

How Hoxton Mix can help

At Hoxton Mix, we aim to help UK startups thrive. Most importantly, if you do create a company that employs only remote workers, we can provide you with a virtual office registered to an impressive London business address, with costs starting from just £0.41 per day, saving you thousands of pounds per year compared to maintaining your own building.

If you prefer a hybrid business model for your startup, our London meeting rooms can be booked by the hour, so you only pay for workspace as and when you need it.

Even if your remote workers are based outside the UK, there’s no reason why your customers need to pay extra for calls. Simply sign up for a virtual office phone number through Hoxton Mix and have calls diverted to any UK mobile or EU/US/UK landline.

The Hoxton Mix’s business mail forwarding services let you truly work from anywhere while maintaining a professional UK presence. With our Virtual Office London, all your post is scanned and emailed to you the same day it arrives — ideal if you're looking for reliable mail scanning services. Need the originals too? Just add our UK Mail Forwarding service to have physical copies automatically forwarded to any UK address.

Final Thoughts

Ultimately, your startup costs will be determined by the size of your business, the industry you’re in, as well as your vision and goals. Although startup expenses can be as little as £1,000, with some careful research and budgeting, you can minimise the costs by doing some of the legwork yourself in website design, price negotiation and organic marketing.

One of the best ways to improve your cash flow is to embrace remote work, and this doesn’t have to mean using your home address to register your business or so you can receive official business correspondence. Although you can register a business at your home address, there are various reasons this isn’t ideal, not least because it will be publicly available information.

Hoxton Mix supports UK startups by offering a professional London business address, remote work solutions and cost-effective services to help get your startup off the ground.

FAQ

How much money is typically needed for business startup costs in the UK?

The amount of money you need to start a business in the UK is roughly £5,000 on average. However, how the exact amount you need to budget varies by sector, with creative and tech startups often requiring just £1,000 or less.

How much does it cost to register a business in the UK?

The cost of business registration in the UK ranges from £12 to £100, depending on the business structure you choose. We recommend working with an experienced business registration provider or accountant, as they can help choose the right structure for your company and file all of the necessary paperwork.

How can I minimise business expenses?

Estimate your business costs by researching your sector thoroughly, then try to negotiate the best prices for both equipment and inventory. Adopting a remote work model can also save your company thousands on commercial office rental, utilities and insurance. You can still enjoy an exclusive London address, mail forwarding and meeting room rental through Hoxton Mix.

Hand-picked related articles

London

Virtual Office

Mail Management